ImmunityBio Stock Jumps 26% as FDA Sets ANKTIVA Resubmission Path

ImmunityBio, Inc. (IBRX) experienced a significant surge in its stock price following news of its regulatory discussions with the U.S. Food and Drug Administration (FDA). On the announced day, ImmunityBio shares jumped approximately 26%, closing at $6.95, a rise of $1.43.

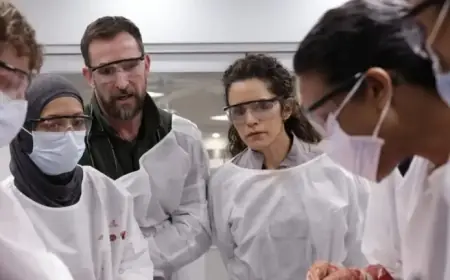

Regulatory Progress for ANKTIVA

The increase in stock value came after ImmunityBio revealed it had received guidance from the FDA regarding the resubmission path for its product, ANKTIVA. This product targets BCG-unresponsive papillary non-muscle invasive bladder cancer.

Positive Investor Reaction

Investors welcomed the guidance since the FDA did not require new clinical trials. This decision was perceived as a significant de-risking of the regulatory process. Many viewed it as a positive indication of a possible label expansion for ANKTIVA.

Despite opening lower on the day of the announcement, the stock saw a rapid rise in intraday trading. The buying momentum accelerated, resulting in trading levels well above the previous close.

Strong Trading Volume

The trading volume for ImmunityBio exceeded its average daily activity considerably. This spike highlighted robust investor interest in the update on ANKTIVA’s regulatory status.

Stock Volatility

ImmunityBio’s stock has shown considerable volatility over the past year, with a 52-week price range reflecting fluctuations tied to developments regarding ANKTIVA’s commercialization. The stock’s performance remains highly sensitive to changes in clinical and regulatory landscapes.

- Stock Jump: 25.82%

- Closing Price: $6.95

- Increase: $1.43

- FDA Guidance: No new clinical trials required

- Trading Venue: Nasdaq

As the situation develops, ImmunityBio’s stock stakeholders will be keeping a close watch on the further progress of ANKTIVA and its impact on the company’s market position.