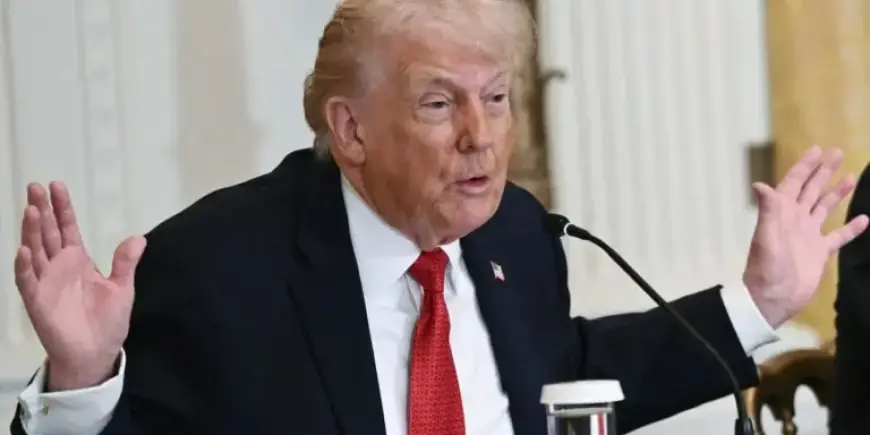

Watchdog: Trump Increased National Debt by $2.25 Trillion in First Year

In a notable update on the U.S. national debt, former President Donald Trump’s first year back in office resulted in an increase of approximately $2.25 trillion. This surge highlights the rapid pace at which federal borrowing is escalating, raising red flags among budget analysts and fiscal experts.

Key Statistics on National Debt Growth

As of January 9, 2026, the national debt had reached $38.4 trillion. The growth trajectory indicates alarming borrowing rates, as the total national debt has been climbing at an estimated $71,884.09 every second. Notably, during the calendar year 2025, the federal government added around $2.29 trillion to the national debt, reflecting a significant increase in fiscal pressure.

Annual Debt Comparisons

- Trump’s First Year: National debt increased by $2.25 trillion.

- 2025 Overview: Debt growth was about $2.29 trillion.

- Outstanding Rate: National debt grew from $37 trillion to $38 trillion from August to October, marking the fastest growth outside the pandemic.

- Historical Context: Trump and Biden combined account for the top five highest debt incurring years in the last six years.

Interest Costs and Financial Implications

The rising national debt has coincided with soaring interest costs. For the fiscal year 2025, net interest payments totaled nearly $970 billion. The Congressional Budget Office (CBO) highlighted that these payments, when combined with other federal expenses, surpassed the $1 trillion mark for the first time.

Future Projections

- The Committee for a Responsible Federal Budget estimates annual interest payments to reach $1 trillion going forward.

- Despite increased tariff revenues—estimated to be between $300 billion to $400 billion—these funds are insufficient to cover the escalating interest costs.

Market Reactions and Voter Sentiment

Financial markets are beginning to react to the intensifying debt situation. Auctions for new Treasury securities have seen rising yields, which signal unease among investors regarding the volume of U.S. borrowing. Analysts have described the growing debt load as America’s “Achilles’ heel,” potentially exposing the economy to future shocks, especially amidst geopolitical tensions.

Recent polling data reveals that around 82% of Americans view the national debt as a serious issue, reflecting widespread concern despite divisions over fiscal policies. Trump’s initial promise to reduce the debt now stands in stark contrast to its record increase during his current term.

As the administration enters a new year filled with potential fiscal challenges, the focus is shifting from a debate over the pace of debt accumulation to the sustainability of the world’s largest economy under this mounting pressure.