Stock Market Rotation 2026: Sectors Surpassing Tech Growth

The stock market is witnessing a notable rotation in early 2026, with small-cap companies emerging as leaders over large-cap firms. This shift reverses the trends seen in 2025, as small caps have surged while the tech sector faces challenges.

Market Trends: Small-Cap Companies Surge

Small-cap companies have demonstrated impressive growth, gaining 5.57% year-to-date, contrasting sharply with large-cap firms, which have only seen a modest increase of 0.56%. This marks a significant turnaround in market dynamics.

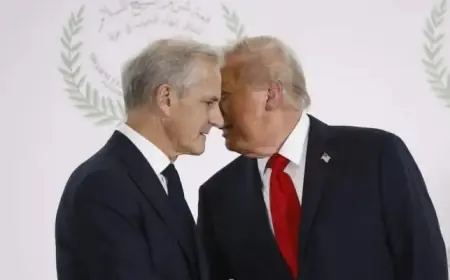

Industry Insights from Experts

- Michael Arone, chief investment strategist at State Street, noted, “We are most definitely seeing a rotation, and it has picked up some momentum from the end of last year.”

- This shift reflects the ongoing strength of the US economy and geopolitical changes that could sustain this market rotation throughout the year.

Tech Sector Struggles After 2025 Success

After a strong performance driven by AI investments in 2025, the tech sector is now the worst performer, reporting a loss of 0.40% this year. The average profit growth of tech stocks is declining, impacting overall market sentiment.

Sector Performance Overview

- Basic Materials: Leading with a 9.05% rise.

- Industrials: Showing positive growth.

- Energy Sector: Performing well amid market shifts.

Despite current struggles, some tech companies, like Taiwan Semiconductor Manufacturing, announced record earnings, hinting at potential recovery.

Future Outlook: Sustained Growth Potential

Analysts believe that continued fiscal support coupled with favorable conditions could extend this market shift. Improved earnings among small-cap and non-tech companies suggest a broader market rally is on the horizon.

Reversing Trends and Economic Indicators

- Small-cap firms are performing well, with 5.94% gains in the value index compared to large-cap’s 2.80%.

- Growth metrics also show small-cap dominance at 6.02%, against large-cap growth of just 0.13%.

- Investor interest is shifting towards real assets, driven by recent geopolitical events.

Investors are focusing on diversifying portfolios, favoring sectors like materials and mining, which stand to benefit from broader economic trends.

Conclusion: Navigating Market Changes in 2026

As the US economy continues to exceed expectations, it fuels the growth of small-cap companies. Factors such as fiscal stimulus, lower interest rates, and geopolitical developments are crucial in shaping this evolving investment landscape.

Experts like Arone emphasize the importance of recognizing the changing market dynamics. A sustained rotation could redefine investment strategies in 2026 and beyond, highlighting the need for adaptability in a shifting economic environment.