Trump Unveils Bitcoin Price Shift, Raising Serious Concerns

Bitcoin prices have seen a significant upward trend, approaching the $100,000 mark as we move into 2026. Currently, bitcoin has increased over 10% since December lows, although it still hasn’t reached its October peak of $126,000. This rise occurs amidst cautious market sentiment following a severe $6 trillion warning from the CEO of Bank of America concerning cryptocurrencies.

Trump’s Federal Reserve Chair Decision Impact

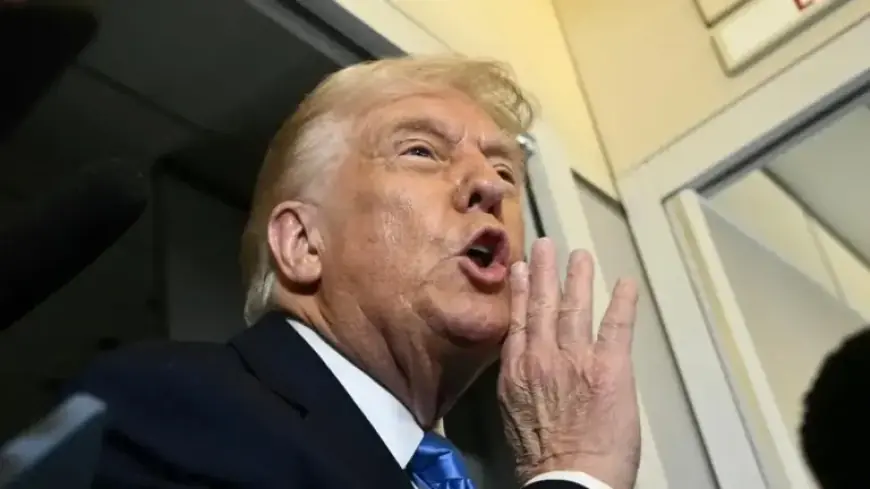

Recently, U.S. President Donald Trump stated that he is unlikely to nominate Kevin Hassett as the new Federal Reserve chair. This news raises concerns among traders, particularly with respect to the potential fluctuation of bitcoin prices. Trump’s remarks came during an event at the White House, where he expressed his desire to keep Hassett in his current role.

Trump’s Comments and Market Reactions

Trump emphasized his appreciation for Hassett, saying, “I actually want to keep you where you are, if you want to know the truth.” Following these comments, the odds of Hassett being chosen for the role dropped dramatically, while former Fed governor Kevin Warsh’s odds surged to nearly 60%. This shift indicates traders’ apprehensions about the implications for bitcoin should Trump choose Warsh, who is seen as less dovish compared to Hassett.

- Trump’s preference for Hassett could have been supportive for crypto prices.

- Warsh has financial ties to the crypto sector but is expected to maintain stricter interest rates.

- Expectations of a potential decrease in interest rates have bolstered the crypto market.

Future Implications for Bitcoin Prices

Changes in Fed leadership could significantly affect bitcoin’s trajectory. Analysts note that an announcement from Trump about his nominee is anticipated soon, adding to the speculative environment surrounding the cryptocurrency. As traders prepare for the upcoming news, bitcoin’s price continues to rally, driven by bullish market sentiment.

In conclusion, the evolving situation regarding the Federal Reserve chair position and its impact on interest rates will be closely monitored by crypto investors. The potential effects on bitcoin prices remain significant as previously indicated shifts in policy could dictate the cryptocurrency market’s direction in 2026.