Adani Enterprises Achieves Rs 11,985 Crore EBITDA in First 9 Months of FY26

Adani Enterprises Ltd. (AEL) has demonstrated a solid operational performance during the first nine months of Fiscal Year 2026. The company reported a consolidated EBITDA of ₹11,985 crore, with total revenues amounting to ₹69,756 crore for the same period.

Key Developments and Achievements

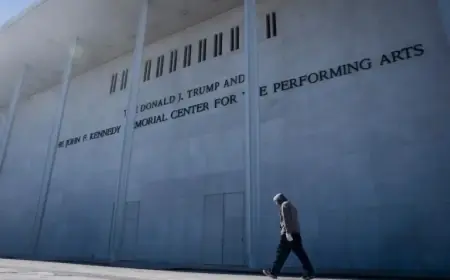

- AEL commenced operations at the Navi Mumbai International Airport on December 25, 2025.

- This airport, with an initial capacity of 20 million passengers per year, enhances India’s aviation infrastructure.

- Adani Enterprises recorded a profit before tax (PBT) of ₹3,581 crore, excluding a significant gain from asset sales.

Financial Performance

Profit before tax, including exceptional items, surged to ₹12,796 crore. Additionally, profit after tax attributable to owners saw a remarkable increase of 193% year-on-year, reaching ₹9,560 crore.

Statements from Leadership

Gautam Adani, Chairman of Adani Group, emphasized the company’s operational resilience and strategic focus. He noted the milestone achievement of the Navi Mumbai International Airport as a testament to their commitment to developing critical infrastructure quickly. He stated, “Our continued progress across various sectors positions us well to drive further growth as India moves towards a $5 trillion economy.”

Segment Highlights

- The airports segment achieved a revenue increase of 31% and EBITDA growth of 47%.

- Passenger movement at Adani-managed airports reached 70.6 million in the first nine months of FY26.

- Adani Solar ranked among the top 10 solar module manufacturers globally, marking a significant position for an Indian company.

- Domestic solar module sales grew by 40%, totaling 997 MW in the last quarter of 2025.

- AEL expanded its data center capacity to over 50 MW through its branch, AdaniConnex.

- The infrastructure segment operationalized two hybrid annuity model road projects, bringing the total to nine.

Capital Market Initiatives

In capital market activities, AEL successfully completed a ₹24,930 crore rights issue, over-subscribed by 30%. Additionally, the company raised ₹1,000 crore through a public issue of non-convertible debentures in January 2026, further strengthening its financial position.

Future Directions

Adani Enterprises remains committed to incubating large-scale, competitive businesses that align with India’s long-term infrastructure and sustainability objectives. The company is poised for accelerated growth through innovative projects and robust financial backing.