Bitmine Immersion Technologies Reveals $10.7 Billion in Crypto and Cash Assets

Bitmine Immersion Technologies has recently disclosed its substantial crypto and cash assets, amounting to $10.7 billion. This figure includes significant holdings in Ethereum and Bitcoin, alongside considerable stakes in businesses within the crypto space.

Overview of Bitmine’s Assets

As of February 1, 2026, Bitmine’s total crypto portfolio is highlighted by:

- 4,285,125 ETH valued at $2,317 each, totaling approximately $9.9 billion.

- 193 Bitcoin (BTC).

- A $200 million investment in Beast Industries.

- A $20 million stake in Eightco Holdings (NASDAQ: ORBS).

- Cash reserves amounting to $586 million.

Ethereum Holdings

Bitmine’s holdings consist of 3.55% of the total Ethereum supply, which is 120.7 million ETH. The company’s strategy has emphasized accumulating Ethereum, especially following recent price adjustments.

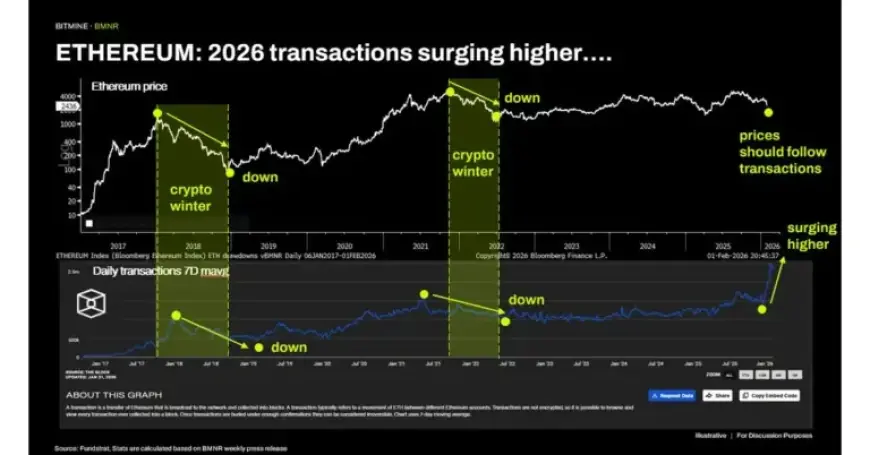

Despite Ethereum’s price decline—from approximately $3,000 to around $2,300—on-chain metrics indicate strong fundamentals. Notably, Ethereum reached an all-time high of 2.5 million daily transactions, while active addresses soared to 1 million.

Market Analysis by Thomas Lee

Thomas “Tom” Lee, Executive Chairman of Bitmine, noted that the decline in ETH prices does not reflect its underlying strength. Instead, he attributes the downturn to non-fundamental factors, including the impact of market leverage and rising precious metal prices.

Investment Strategies

This week, Bitmine acquired an additional 41,788 ETH, bringing its staked Ethereum total to 2,897,459 ETH, valued at approximately $6.7 billion. This reflects an increase of 888,192 ETH over the past week.

- Annualized staking revenues have risen to $188 million, up 18% in a week.

- Projected annual staking rewards at scale could reach $374 million.

MAVAN Initiative

Bitmine is on track to launch the Made in America Validator Network (MAVAN), a state-of-the-art staking infrastructure, in early 2026. This infrastructure aims to bolster the security and efficiency of Ethereum staking operations.

Market Position

Bitmine currently holds the title of the largest Ethereum treasury globally and ranks second in total crypto treasury holdings, following Strategy Inc. (NASDAQ: MSTR). The latter possesses 712,647 BTC valued at $55 billion.

According to Fundstrat data, Bitmine’s stock trades with an impressive daily dollar volume average of $1.1 billion, ranking it #105 among US-listed stocks.

Conclusion

Bitmine continues to position itself as a formidable player in the cryptocurrency market. With its strategic investments and the impending launch of MAVAN, the company is poised to leverage the increasing demand for Ethereum staking and decentralized finance solutions.

For more updates on Bitmine’s developments, visit Filmogaz.com.