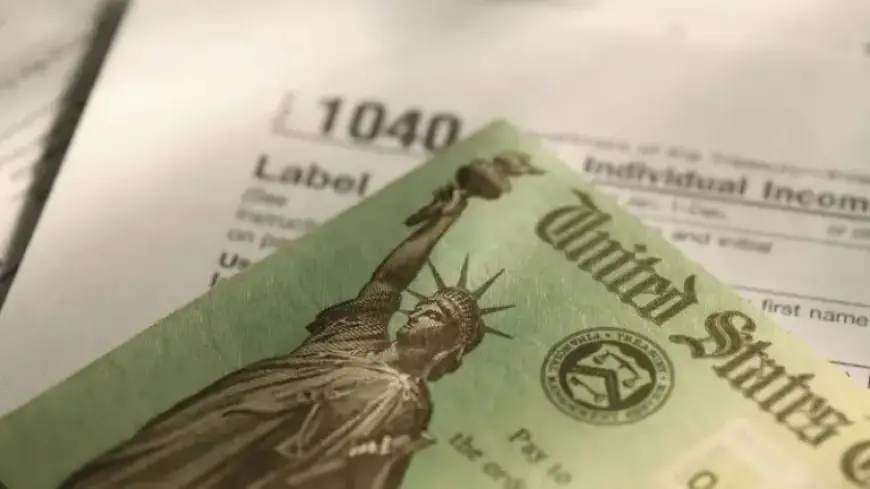

Federal Tax Refunds Set to Increase: Here’s Why

As tax-filing season approaches its April 15 deadline, American taxpayers can expect a higher federal tax refund this year. The IRS suggests that an average refund may surge by approximately $1,000 per household, resulting from recent tax law changes effective for the 2025 tax year.

Key Factors Behind Increased Federal Tax Refunds

Several factors contribute to the anticipated rise in refunds, primarily stemming from new tax benefits and unchanged withholding practices from the previous year.

Tax Breaks Introduced for 2025

- Enhanced Standard Deduction: The standard deduction has increased by $750, bringing it to $15,750 for single filers and $31,500 for married couples filing jointly. This change decreases taxable income, benefiting millions.

- Expanded SALT Deduction: Filers in high-tax states can now deduct up to $40,000 in state and local taxes, a significant increase from the previous limit of $10,000. This adjustment may encourage more taxpayers to itemize their deductions.

- New Senior Deduction: Seniors aged 65 and older can benefit from a new $6,000 deduction ($12,000 for joint filers), designed to reduce their tax liability significantly. Over 30 million seniors are expected to benefit from this provision.

The Role of Withholding Adjustments

Taxpayers generally saw a reduction in their tax liabilities due to these new benefits. However, many did not adjust their withholding amounts last year. Consequently, the “extra” tax benefits will appear in the form of larger refunds rather than smaller tax bills.

Tom O’Saben from the National Association of Tax Professionals noted that taxpayers whose financial situations have remained stable are likely to see a notable increase in their refunds. Adjusting withholdings can help balance cash flow throughout the year, but it should be done cautiously to avoid underpayment penalties.

Understanding Your Refund

A larger refund can be viewed in two ways:

- As an interest-free loan reimbursed by the government.

- As a forced savings mechanism, providing a lump sum at tax time.

While a refund can provide a sense of security, taxpayers may also consider adjusting their withholding for better cash flow during the year. This may allow them to put their money in high-yield savings accounts or pay down debts more effectively.

Upcoming Changes to Withholding

Adjustments to IRS income tax withholding tables for 2026 have already been implemented, reflecting recent tax changes. Taxpayers are encouraged to consult tax advisers to ensure their withholding aligns with the expanded benefits available for the current tax year. This proactive step can significantly impact overall tax liabilities and cash flow.

In summary, due to new legislation and various expanded deductions, federal tax refunds are expected to rise significantly this year. Taxpayers should remain informed and proactive in managing their finances to maximize their benefits.