Global Stocks Plunge Amid US-Europe Tensions on Greenland and Tariffs

Global stock markets faced a sharp decline as tensions escalated between the United States and Europe. Investors reacted to President Donald Trump’s controversial remarks regarding Greenland and his threats of new tariffs.

Market Reactions to Rising Tensions

On Tuesday, Europe experienced a 1% dip in its benchmark Stoxx 600 index, which tracks stock performance across multiple countries. This decline followed a significant drop of 1.19% the previous day, marking its worst performance since November. In Denmark, the OMX Copenhagen 20 index fell by 0.1%, also following a much steeper decrease of 2.73% on Monday, its worst day since October.

Impact on US Markets

In the U.S., stock futures indicated a rocky start. The Dow futures were down by 765 points, reflecting a 1.5% drop. Similarly, S&P 500 futures fell by 1.7%, while the Nasdaq 100 showed a decline of 2%. This came as U.S. markets resumed trading following a closure for Martin Luther King Jr. Day, giving traders their first full opportunity to respond to recent developments.

Investor Sentiment and Economic Outlook

Market analysts expressed concern over the ramifications of Trump’s policy shifts. George Vessey, a strategist at Convera, highlighted how these uncertainties affect investor confidence. Ed Yardeni from Yardeni Research noted the unpredictability of the current market environment, emphasizing the need for caution as various factors may influence market dynamics.

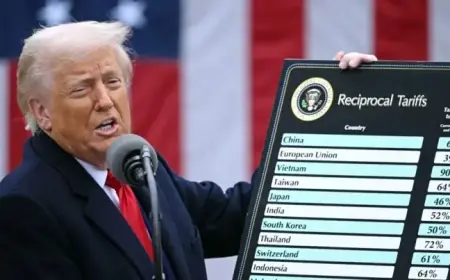

Ongoing Legal Challenges and Tariffs

Legal aspects surrounding tariffs are also at play. The U.S. Supreme Court is currently evaluating the legality of Trump’s use of the International Emergency Economic Powers Act of 1977. This ruling could significantly affect Trump’s ability to impose further tariffs on European imports.

Potential Retaliation from Europe

As tensions continue to rise, the European Union has indicated it may respond retaliatorily. This includes the potential implementation of an ‘anti-coercion instrument’ aimed at U.S. companies operating in Europe. Known as the “trade bazooka,” this policy is intended to counter threats from foreign governments that may harm EU interests.

Shift in Market Dynamics

As investors look for safe havens, precious metals have seen a surge in prices. Gold futures have risen by 3%, while silver futures increased by 7.3%. Analysts believe the current tariff situation has escalated trade tensions beyond logical economic reasoning, leading to serious implications for both the U.S. and European economies.

- Stoxx 600 Index: Down 1% on Tuesday

- OMX Copenhagen 20 Index: Down 0.1%

- Dow Futures: Down 765 points (1.5%)

- S&P 500 Futures: Down 1.7%

- Nasdaq 100 Futures: Down 2%

- Gold Futures: Up 3%

- Silver Futures: Up 7.3%

As global investors monitor these developments closely, it is clear that the U.S.-Europe tensions over Greenland and impending tariffs will remain a focal point in market analysis. The outcomes of these interactions and legal decisions could lead to lasting effects on international trade and economic stability.