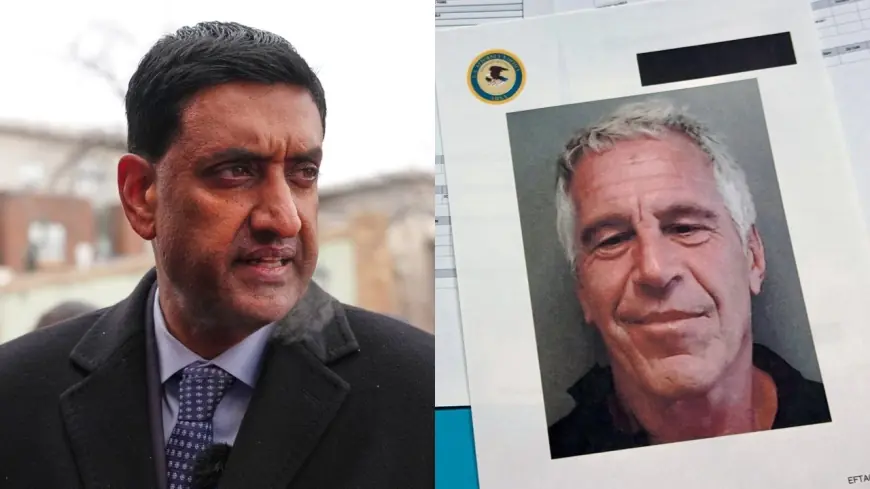

Ro Khanna’s Epstein-File Name Reveal Pulls Les Wexner and Sultan Ahmed bin Sulayem Into a Fresh Political Storm

A new political firestorm is building around the latest batch of Jeffrey Epstein-related materials after Representative Ro Khanna publicly read out a set of names that had appeared in documents with redactions. The move has rapidly widened the controversy from a transparency fight inside Washington to reputational and financial pressure on prominent figures and institutions that now find themselves pulled into the same orbit of questions.

The immediate fallout is already tangible: investors have begun pausing or reassessing ties with a major global ports operator led by Sultan Ahmed bin Sulayem, while Ohio billionaire Les Wexner is facing renewed legal attention in an unrelated case tied to long-running allegations of abuse at a major university. At the same time, the political incentives are sharpening for lawmakers who see the Epstein files as both a test of government credibility and a weapon in broader culture-war messaging.

What happened: Khanna names individuals tied to redactions

In recent days, Khanna said he reviewed unredacted materials and then read six names aloud in a public setting, arguing that redactions were applied inconsistently and that the public deserved clarity about who is appearing in the records. Among the names he read were Les Wexner and Sultan Ahmed bin Sulayem. He also included Salvatore Nuara and Leonic Leonov, two names that have drawn outsized attention precisely because little reliable public context has emerged about them so far.

Khanna has stressed a central caveat: appearing in a file does not equal wrongdoing. Still, in modern politics, being named is often enough to trigger reputational damage, institutional distancing, and a cycle of demands for more disclosure.

Les Wexner: parallel legal pressure adds to the spotlight

Wexner’s name resurfacing in the Epstein context is landing at the same moment he faces a separate legal development: a judge has ordered him to testify in litigation connected to decades-old sexual abuse allegations involving a former university doctor. That case is distinct from Epstein, but the convergence matters politically. When multiple high-profile controversies touch the same figure, even indirectly, the story becomes less about one set of allegations and more about power, oversight, and whether elite networks were insulated from scrutiny.

The practical effect is that Wexner’s public posture and legal strategy now play out under intensified attention, with every procedural step likely to be interpreted through the broader “who knew what, and when” frame.

Sultan Ahmed bin Sulayem: investors step back as pressure rises

For bin Sulayem, the story has moved quickly from reputational damage to potential business consequences. Major institutional partners have begun pausing new investments or future deals with the ports and logistics operator he leads while seeking clarity on the allegations and the nature of his past interactions with Epstein. Even without any criminal charge, this is the kind of risk that corporate boards and large investors treat as existential: it can affect financing, counterparties, and long-term contracts that rely on trust.

This is where the “ring” dynamic matters. Large institutions operate within a small circle of risk managers, lenders, insurers, and co-investors. When one player signals concern, others often follow to avoid being the last institution standing when reputational smoke turns into a governance fire.

Where Lauren Boebert fits: political incentives collide with transparency demands

Representative Lauren Boebert has been vocal in recent disputes about the Epstein files and government transparency. Her involvement intensifies polarization: supporters frame it as accountability, while critics see it as selective outrage designed to energize a base rather than build a consistent standard for disclosure and due process.

This tension is the story’s political core. One faction wants maximal sunlight on the grounds that secrecy protects the powerful. Another warns that unstructured releases and name-forward politics can create a punishment-by-association machine. Both sides have incentives to keep the fight loud: it drives fundraising, media attention, and partisan identity.

What we still don’t know: the missing pieces that decide the next phase

Several unresolved questions will determine whether this remains a politically noisy episode or becomes a sustained institutional crisis:

-

What, specifically, the documents say about each named individual’s role, if any, beyond contact or mention

-

Why certain names were redacted in some places but visible elsewhere, and whether that reflects policy, error, or inconsistent application

-

Whether Salvatore Nuara and Leonic Leonov are misidentified, minimally involved, or tied to undisclosed contexts not yet public

-

Whether any formal internal review or procedural change emerges around how future releases are handled

-

Whether corporate governance actions follow for any executive pulled into the controversy, even absent criminal exposure

What happens next: scenarios and triggers to watch

-

A structured transparency process replaces ad hoc disclosure

Trigger: lawmakers force clearer release standards, including consistent redaction rules and explanatory memos. -

Corporate fallout escalates around bin Sulayem

Trigger: additional large investors freeze activity, lenders reprice risk, or boards demand governance changes. -

The story shifts toward litigation and subpoenas

Trigger: new court filings, testimony schedules, or discovery requests connect separate cases through overlapping timelines or relationships. -

A partisan escalation cycle hardens positions

Trigger: prominent figures turn the episode into campaign messaging, prompting counter-allegations and selective document framing. -

The controversy cools without institutional change

Trigger: no further revelations, no formal actions, and public attention moves on—until the next tranche of materials reignites the debate.

Why it matters

This is not just about names in files. It is a stress test of how democracies balance transparency with due process, and how quickly reputational risk can become financial risk when elite networks intersect with public outrage. The stakeholders are broad: alleged victims seeking accountability, public officials seeking credibility, corporations managing trust, and voters trying to distinguish proven fact from insinuation. The next few days will reveal whether Washington channels the moment into clearer rules—or whether it becomes another episode where the loudest incentives win and the underlying accountability questions remain unresolved.